Fixed Income Market Summary—October 2018

US Treasuries – Treasury yields rose across the curve in October, continuing their rise to the highest level year to date. There was, however, a slight interruption in the middle of the month to this upward trend as volatility proved that Treasuries are still the beneficiary of a flight to quality during equity market stress.

Municipals – Municipal yields rose across the curve and there were noticeable outflows from municipal mutual funds in October. Forward looking supply-demand dynamics could be favorable, but municipals have yet to gain strong footing this year.

Corporates – Corporate spreads versus Treasuries continue to widen as the threat of higher borrowing costs pervades all fixed income markets. M&A activity continues to drive strong supply but concerns over credit due to highly leveraged issuers is slowly bubbling towards the surface.

[vcex_divider color=”#dddddd” width=”100%” height=”1px” margin_top=”20″ margin_bottom=”20″]

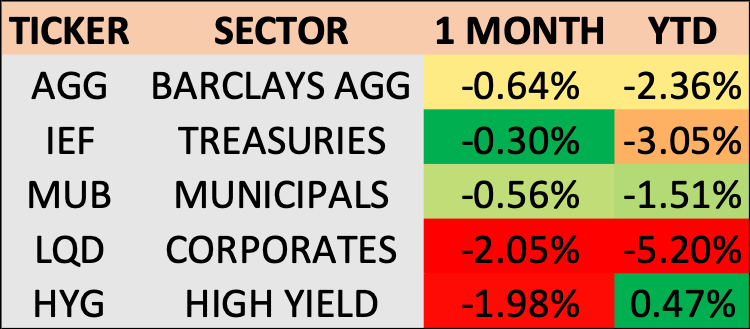

BOND MARKET PERFORMANCE SNAPSHOT:

Major bond sectors are down across the board year to date, as measured by the ETFs in the table above. Of the investment grade credits, municipals have held up the best. High yield, which tends to correlate to equities, are slightly up this year after a tough October. Investment grade corporates continue to lag, as rising rates and equity market swings have reduced demand, as evidenced by corporate spreads widening.

TREASURY MARKET OVERVIEW:

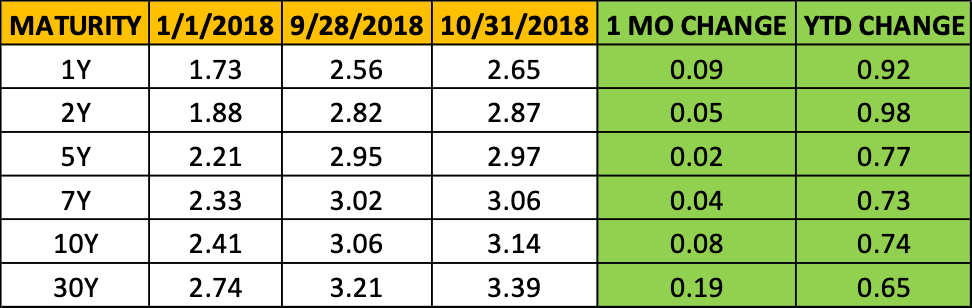

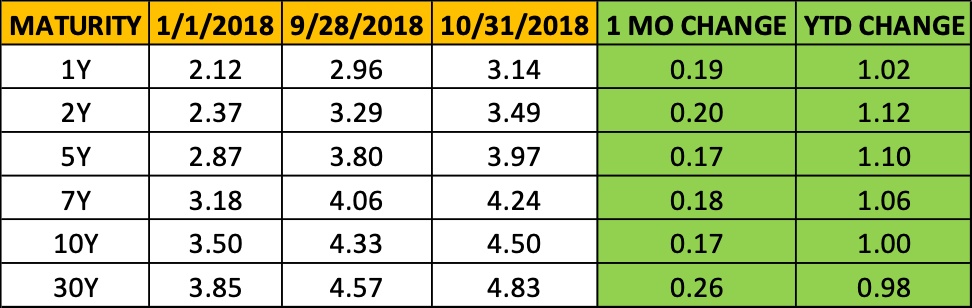

TREASURY YIELD SUMMARY:

The bout of volatility in the equity markets during October showed that Treasuries are still viewed as dry land during these storms. When the S&P 500 dropped 9.5% from October 3 to October 29, Treasuries responded positively. The 10-year Treasury yield dropped about 0.15% and IEF which tracks 7-10 year Treasuries rose about 1% in price.

It goes back to the chicken or the egg conversation with the bond/stock relationship. During the middle of October, equity markets dropped due to geopolitical tensions and growth concerns, so Treasuries reacted positively. However, if stocks are dropping due to fears that rising interest rates and monetary tightening will slow the economy, then bonds really don’t offer a margin of safety. We have seen both environments this year, but for pockets of time when stocks struggled, Treasuries at least provided ballast for investors.

The Treasury yield curve steepened in the month of October, a change from the consistent flattening we have seen throughout most of 2018. However, the 2-10 spread continues to hover around 10 year lows and sits at 0.27% at the end of the month.

One thing to keep an eye on in the Treasury market is issuance and its effect on the average maturity of Treasuries in the market place. Issuance has markedly increased this year to fund the deficit and, as the Fed continues to be a diminished buyer of these securities, issuance plays a more significant role in the price. The weighted average maturity of Treasuries sits at 70 months, higher than the long-term average since 1987 of 62 months. That number has steadily risen since 2008 as lower rates prompted the Treasury to extend the maturity on their bonds to satisfy market demand for yield.

The Federal Reserve expectedly raised rates at their last meeting at the end of September. The expectation is for a hike at December’s meeting as fixed income markets are currently pricing in a 67.1% probability.

[vcex_divider color=”#dddddd” width=”100%” height=”1px” margin_top=”20″ margin_bottom=”20″]

MUNICIPAL MARKET OVERVIEW:

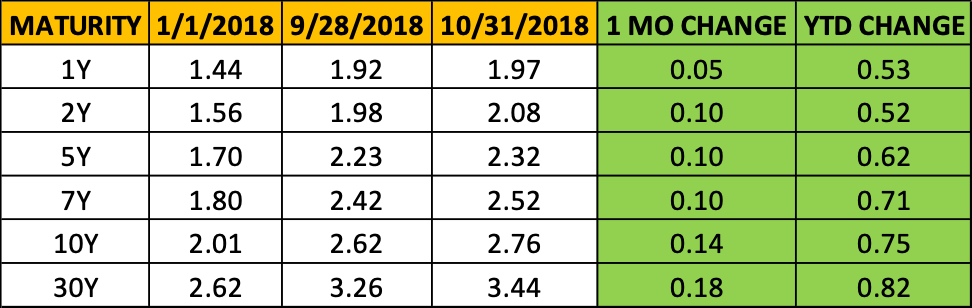

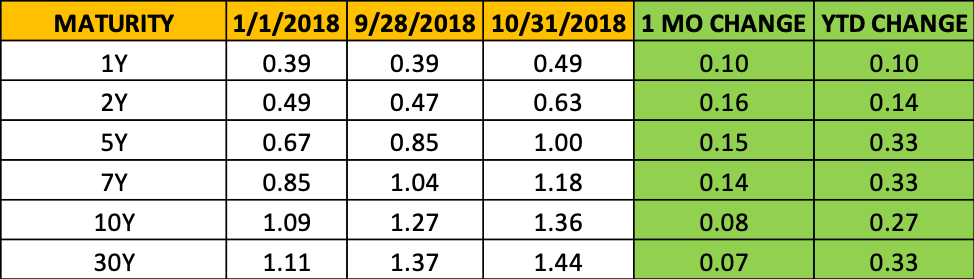

TAX-EXEMPT MUNICIPAL YIELD SUMMARY:

Municipals bond yields followed the rest of the market higher and the sector continues to show weakness in October. Investors withdrew $1.4 billion from municipal bond mutual funds in the week ending October 17, a fifth straight week of outflows.

However, forward-looking supply-demand dynamics show a favorable outlook going into the end of the year. Approximately $70 billion of debt is expected to mature or be called by the end of the year, a potential source of demand as investors look to reinvest principal and interest payments.

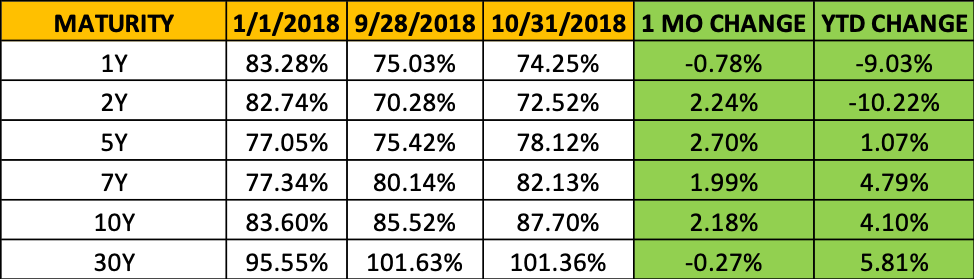

TAX-EXEMPT MUNICIPAL YIELDS AS A PERCENTAGE OF TREASURY:

The front end of the municipal curve continues to be expensive relative to Treasuries. Investors aren’t really getting paid to own municipals on that spot of the curve, even from a tax-equivalent yield perspective. More value can be found in that 7-10 year range, and even further out if investors are willing to extend duration.

Next week’s midterms will have a large impact on the municipal bond market, as $76.3 billion of bond sales will be decided on several states’ ballots. Projects include water infrastructure projects in California, bridge expansions in Colorado and school construction in Texas and North Carolina. This is the most in an election since 2006 and signals a change in attitude of municipalities who may have delayed capital projects in the past after the recession. All of this in the backdrop of a federal government that may push to increase infrastructure spending if Democrats take control of the house.

A recent development in this market relates to callable municipals, almost all of which are issued with 10-year call provisions. In 2018, almost 20% of new issue deals have included call features between 5-9 years, a significant uptick. This can be attributed to issuers that want the option to refund their debt if rates decline and they need to restructure, instead of waiting the entire 10-year period. Investors have responded positively, as hikes by the Fed have make these bonds with shorter durations more attractive due to their defensive profile in the middle of this tightening cycle.

[vcex_divider color=”#dddddd” width=”100%” height=”1px” margin_top=”20″ margin_bottom=”20″]

CORPORATE MARKET OVERVIEW:

INVESTMENT GRADE CORPORATE YIELD SUMMARY:

CORPORATE BOND SPREADS VERSUS TREASURIES:

Yields continue to rise across the corporate curve and equity volatility during October contributed to even larger losses in corporate bonds than the rest of the market. Junk bonds received additional pressure from the oil price slump, and high-yield issuance in October was the lowest for a month since 2015. Corporate spreads widened significantly in October, as equity market volatility picked up and demand for corporate bonds eased.

One thing to keep an eye on in the corporate bond market is credit ratings. There is currently about $2.47 trillion of US corporate debt rated BBB, more than triple the level at the end of 2008. This now makes up 49% of the investment-grade corporate market and has eclipsed the US Junk bond market. For context, this number was 27% in 1993.

With many of these ratings dependent on the ability of companies to service their debt, any economic cycle changes may lead to investors pulling cash and a surge of downgrades to junk. In the last 3 economic downturns, between 7% and 15% of investment grade corporate bonds were downgraded to junk, according to a report from Morgan Stanley. Some estimates this time around have that number as high as 40%, which would be close to $1 trillion dollars of debt downgraded to junk.