Don’t Confuse Maturity With Duration

Owning a Portfolio of Actively Managed Individual Bonds will be Critical in a Rising Rate Environment.

For advisors that allocate to fixed income (and we assume that to be most), the days of simply buying bond mutual funds/ETFs and having them sit essentially unmanaged in client portfolios are quickly coming to an end.

Rising interest rates will erode the principal in these vehicles with no certainty of when it may be recovered. Instead, one should invest in a portfolio of actively managed individual bonds.

The rising interest rate environment creates a conundrum for advisors. We all know that a fixed income allocation is an integral part of any well-balanced portfolio. Yet, in a rising rate environment, relying on bond funds/ETFs will not accomplish the goal of balancing a portfolio, earning a return, and preserving capital. So how should the advisor respond to this new dynamic?

Part of MacroView’s mission as a firm is to help educate advisors so that they better understand and analyze various fixed income topics that are essential to properly managing client portfolios.

The Essence of Investing: Risk versus Reward

Over the past 30 years, as rates continually declined, risk management in the fixed income space was neglected by most asset allocators and done so with virtually no penalty (for example: the 10-year T-bond has posted just 4 negative calendar year returns since 1988). However, as evidence mounts that the long-term downtrend in rates is coming to an end, risk management within your fixed income allocations is now paramount. Going forward it will be imperative to evaluate the trade-off between (1) risk and (2) reward with respect to your bond allocations.

Risk

With bonds, the measure of risk is a calculation known as “duration.” Duration is a measure of a bond’s price sensitivity to changes in interest rates. For example, if a bond has a duration of 6, its price will drop 6% if interest rates rise by 1% (100 basis points). If a bond has a duration of 10, its price will drop 10% if interest rates rise by 1%. So you see why duration is such an important component when understanding a bond’s risk. We find that too many investors focus on a bond’s maturity date when it is much more important to focus on a bond’s duration.

Reward

The measure of reward in bonds is simply a bond’s yield.

Naturally, one wants to get the most reward (yield) per unit of risk (duration).

How Best to Balance Risk and Reward

If one is truly seeking to optimally balance risk (duration) versus reward (yield), we believe there is no better way to do so than to actively manage a portfolio that includes both tax-exempt and taxable individual callable municipal bonds. Why? The key is the callable feature of the municipal bonds.

What is a callable bond?

Callable bonds are bonds that allow the issuer to redeem the bond (return the full principal) on a date prior to the maturity date. For example, a bond that has a maturity date in 2035, might have a call date in 2025.

What type of bonds are callable?

Unlike all treasury and most corporate bonds, municipal bonds often come with a call feature generally 10 years out from the issue date. The flexibility that this call feature provides municipalities doesn’t come free however and investors purchasing these bonds get to reap the benefits.

Why would a bond get called?

Callable bonds are issued with a higher than market coupon (ie. 4% or 5% coupon). When the bond reaches its call date, if market rates are lower than the coupon rate, it makes economic sense for the issuer to call the bond, give you your full principal back and refinance at the lower current market rates. This is just like a homeowner refinancing a mortgage.

Why buy callable municipal bonds?

We strongly believe there are exploitable price inefficiencies in the callable municipal bond market that knowledgeable and studious investors can take advantage of. And because of these price inefficiencies, callable municipal bonds offer a higher reward (yield) per unit of risk (duration).

Why do these price inefficiencies exist?

The answer is pretty straightforward: investors often prioritize maturity over duration.

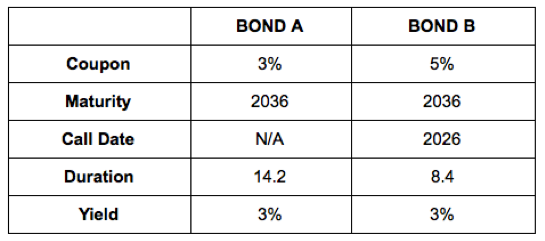

In the chart above, both bonds have a maturity date of 2036. However Bond B has a call date of 2026. This call provision, meaning Bond B may be redeemed in 2026, causes the duration – the measure of the effect of a change in interest rates on the price of a bond – to move down from 14 all the way to 8. Yet these bond generate the same yield! Thus, callable bonds provide the opportunity to generate more yield while taking less duration risk.

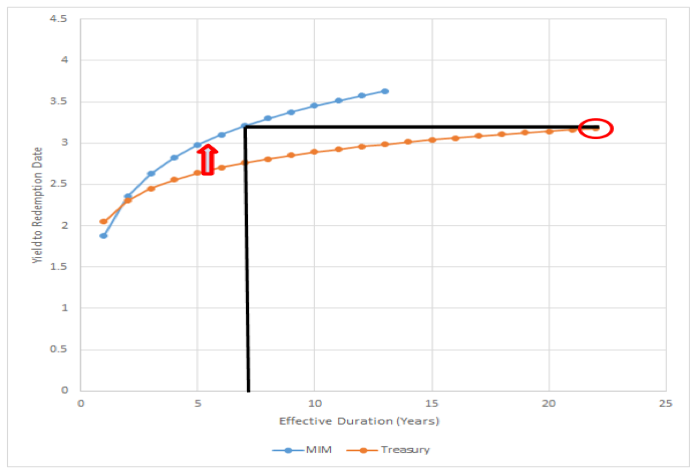

The chart below illustrates further how callable bonds exploit this inefficiency in the municipal bond market. The orange line in the chart represents the yield you receive (y-axis) for the risk/duration you take (x-axis) for the US treasury curve. A risk/reward line. The last data point on the orange line represents a 30-year treasury bond and shows it to have a duration of about 22 with a yield of just over 3%. A duration of 22 means that for every 1% move up in interest rates, a 30-year treasury bond would lose about 22%!

The blue line represents the yield that MacroView’s Enhanced Intermediate Tax-Exempt composite receives for each unit of duration. Currently, the positions in our tax-exempt composite with a yield comparable to that of the 30-year treasury (3.1%) have an average duration of just 7. Said differently, through the use of callable bonds, MacroView only has to take 1/3rd the risk of treasuries to generate the same yield and that’s before you consider the return generated on a tax-equivalent basis for our municipal holdings.

Conclusion

Too many investors focus on the maturity date of a bond when, in fact, the most important component of a bond’s risk is its duration. As shown in the chart above, this confusion between maturity and duration affords investors the opportunity to substantially increase the risk/reward profile of their fixed-income portfolios through tactical employment of bonds with unique structures like call features. With the 10-year treasury yield nearing a 4-year high, having your clients’ fixed-income allocations invested more optimally and efficiently while making sure principal is protected will be more important than ever.

At MacroView, we assist advisors in doing just that. To learn more about how we can provide value to your clients, you can visit us at www.macroviewim.com or call 301-907-6795.