Bonds: Doing Diversification’s Dirty Work

Where are interest rates headed? Naturally, this is a question that is frequently asked to us by both the advisors we work with and our individual clients. Our answer to clients? It doesn’t matter. As we have touched on before, no matter where interest rates are headed, bonds should always have an allocation in a diversified portfolio. For a recent example, let’s use last Tuesday’s equity market drop (the S&P 500 fell -1.15%) which was largely attributed to ongoing Italian political drama and the risk of a Brexit-like event.

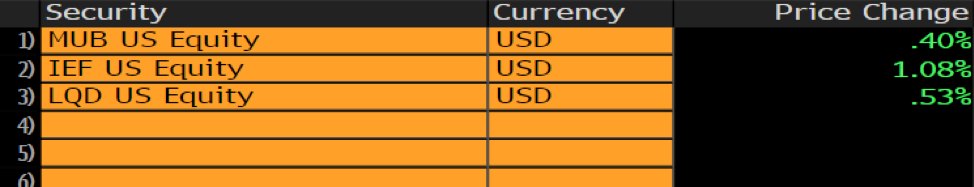

Let’s take a look at how different types of bonds performed on Tuesday.

Investment grade bonds – treasuries (IEF), municipals (MUB), and corporates (LQD) – were all comfortably in the green.

While we believe municipal bonds (both tax-exempt and taxable) offer investors the most value relative to other investment grade options, for the purposes of this discussion, let’s assume for their bond allocation that an investor is equally diversified between treasuries, corporates, and municipals while they allocate 100% of their equities to SPY. Below is a study showing how various diversified portfolios performed on Tuesday, depending on the weighting in bonds.

While the S&P 500 was down 1.15% on Tuesday, a 60% stock/40% bond portfolio was only down 0.4%, and a 40% stock/60% bond was flat.

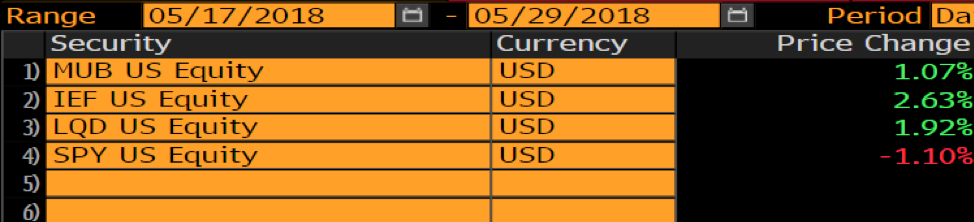

Going further out, here’s how the same ETFs and associated portfolios performed over the last two weeks of May.

By having just a 30-40% allocation to bonds, despite the S&P being down more than 1% over this period, such a portfolio would have achieved a positive return.

While we don’t suggest obsessing over your portfolio’s performance over the very short-term, unforeseen market shocks will always occur and often give rise to an investor’s worst behaviors (making rushed/emotional decisions, selling low/buying high, losing sight of longer-term goals, etc). Historically, an allocation to bonds has allowed long-term, goal-oriented investors the opportunity to stay cool, calm and collected when stock market volatility spikes. They’ll rarely be the sexiest investment in your portfolio but bonds often reveal their greatest significance when equity markets are taking it on the chin.