Rising Rate Environment – Comparing Bond Coupons

Fixed income investors are faced with the challenge of mitigating losses in a rising interest rate environment. Favoring individual bonds over bond funds is one solution for investors who are looking to ultimately protect principal. However, when interest rates rise, individual bonds do not protect investors from a price decline on their bonds in the short-term. Thus, regardless of the vehicle, advisors are faced with the task of protecting their client’s fixed income investments during these rising rate periods.

The common way to measure the interest rate risk of an individual bond is duration. Duration is a measure of a bond’s price sensitivity to changes in interest rates. For example, if a bond has a duration of 6, its price will drop 6% if interest rates rise by 1% (100 basis points). The higher the duration, the greater the price change if interest rates move either up or down. All things equal (coupon, credit), bonds with longer time to maturity will have a higher duration.

With that in mind, the two main strategies investors use to hedge duration risk are owning bonds with:

-Higher coupons

OR

-Shorter maturities

We are going to explore more closely the idea of buying higher coupons to limit price sensitivity in a rising interest rate environment. At the same time, we will try to quantify how individual bonds of various maturities might perform as rates rise.

Important Considerations

Before we dive in and review different scenarios, consider the following:

In many examples of investors, researchers and economists simulating rising interest rates and their effects on bond prices, they often conclude that “If rates rise by X%, then the price of the bond with a duration of Y will decrease by Y%” Without any further context, this should be considered meaningless to an investor. Why? This explanation doesn’t mention anything about the length of time it takes for interest rates to rise by X%.

Many bond pessimists will try to generate shock value by trying to show significant price declines in a rising rate environment. Failing to mention the time period over which an interest rate rise occurs ignores the most important component of fixed income returns and the reason many investors own these securities: income.

In many cases, interest rates rise gradually over a multi-year period. If this happens, the income stream from many fixed income securities comes into the equation and, at the very least, reduces the principal losses, if not overcomes them. Thus, rising interest rates doesn’t always equate to losses in bonds as we will demonstrate.

Higher Coupons – Downside Protection

With these important considerations above, a strategy we recommend is to buy bonds with higher coupons in a rising rate environment. Simply put and as described above, the higher cash flow reduces the sting of price declines over time.

Let’s see how this works in practice by looking at a few different scenarios:

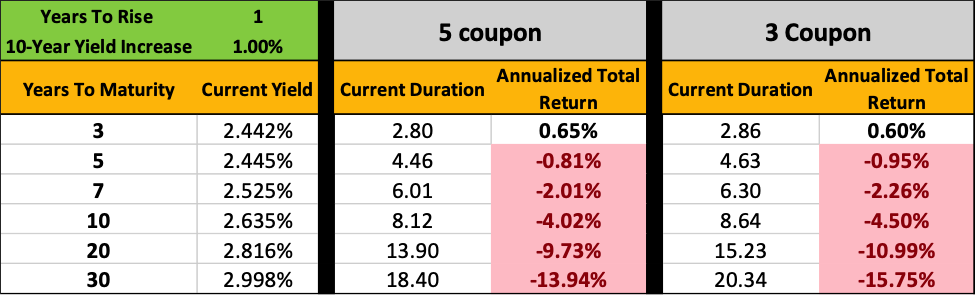

Scenario 1 – One investor owns bonds of various yields and maturities all with a 3% coupon. Another investor owns bonds of the same yields and maturities, but they all have a 5% coupon. Over the next year, the 10-year treasury rises 1% (100 basis points). Below is a chart showing how the different investors’ bonds would have performed over that timeframe:

A couple notable observations:

- Most importantly, the investor with 5% coupon bonds performed better at every maturity date as shown by the annualized total return.

- The difference in performance is gradually more pronounced as maturity is extended. We can attribute this to the increased difference in duration between the 3% and 5% coupon bonds as maturity is extended and therefore price declines are more significant for the 3% coupon bond investor.

- In both cases, 3-year bonds performed positively, despite the rise in interest rates. Even 5-year bonds barely posted negative numbers. This lends credence to the idea that owning bonds with shorter maturities can reduce price volatility and downside risk.

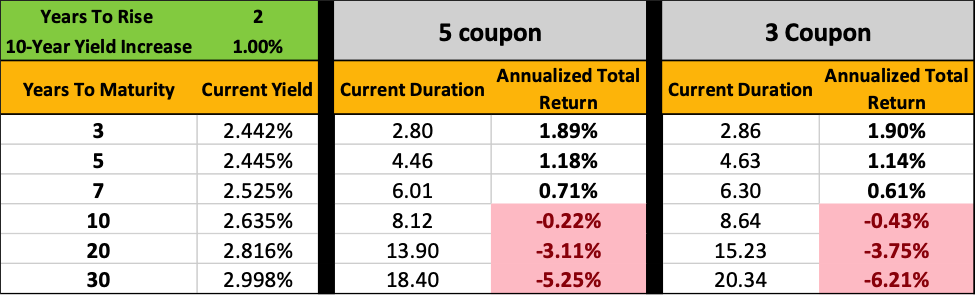

Scenario 2 – One investor owns bonds of various yields and maturities all with a 3% coupon. Another investor owns bond of the same yields and maturities, but they all have a 5% coupon. Over the next 2 years, the 10-year treasury rises 1%. Below is a chart showing how the different investors’ bonds would have performed over that timeframe:

The observations made above remain similar, but the key here is that downside continues to be reduced as the 2-year time frame that it takes for rates to move up 1% gets gradually more offset by the coupons in both cases. As an example, 10-year bonds were down around 4% in the situation where rates rose 1% in 1 year. In this scenario where it takes 2 years to rise 1%, capital was essentially preserved.

Additionally, the return numbers are annualized over the 2-year period. Thus, even though the difference between some of the return numbers by coupon may not seem significant, the effect of compounding comes into play.

Historical Context

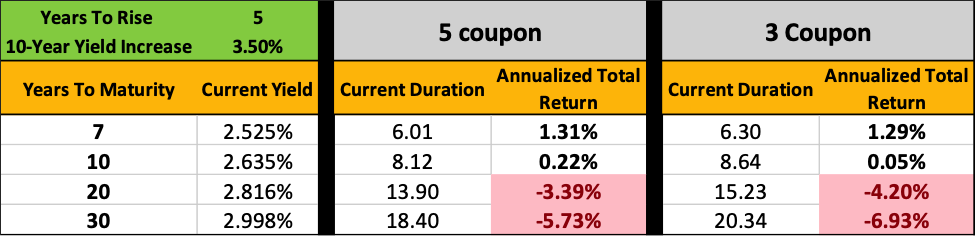

Scenario 3 – The final scenario tries to put this into historical context. As the housing boom cooled and eventually led to recession, the Fed began consistently cutting rates in 2007. This led to a dramatic drop in interest rates across all Treasuries. The Fed plowed through with their pledge to cut interest rates to 0 and began unprecedented Quantitative Easing. The 10-year treasury touched its then all-time low of about 1.6% in 2012. When the Fed began cutting rates in June of 2007, the 10-year was at treasury was at 5.1%. That’s a 3.5% drop over a 5-year timeframe.

With that in mind, let’s say that the Fed continues to tighten, the economy gains firmer footing and pundits are right about the anticipated steep climb in interest rates. Again, using history as a guide, we will project that a consistently tightening Fed and strong economic growth may have a similar path up in interest rates as the path down from 2007-2012. In our minds, this is the “worst-case scenario” in bonds barring a black swan credit event.

One investor owns bonds of various yields and maturities all with a 3% coupon. Another investor owns bond of the same yields and maturities, but they all have a 5% coupon. Over the next 5 years, the 10-year treasury rises 3.5%. Below is a chart showing how the different investors’ bonds would have performed over that timeframe:

Even in our assumed “worst-case scenario,” there was not a complete wash out in bonds with 7 and 10-year bonds earning positive returns. The worst performers, 30-year bonds, lost 6-7% annualized over the 5-year period. While certainly not the normal expectation for bond investors, a 6-7% decline is a bad week in the stock market as a comparison.

Additionally, investors in individual bonds will receive their principal investment back at maturity. Thus, over the remaining life of the bond, investors will earn a higher yield (return) than the stated, original yield at the time of purchase to compensate for these negative return number over earlier life of the bond. Stocks do not have a similar assurance.

Finally, the investor with 5% coupon bonds would get the added advantage of plugging their surplus cash flows into higher yielding bonds as interest rates rose over the course of these three scenarios.

Conclusion

Many fixed income investors are prone to being spooked by the possibility of rising interest rates. But rising interest rates alone is not a death sentence for bonds as many would try to have you believe. There are several strategies investors can use to mitigate risk in a rising rate environment and potentially maintain and grow principal with their bonds, allowing them to serve their original purpose in an investment portfolio.